How to Claim the EV Tax Credit

EV Tax Credit

The federal EV tax credit is a major draw for drivers considering purchasing an electric vehicle (EV). Offering up to $7,500, the tax credit is different as of January 1, 2024, than in prior years. Here’s how to claim this substantial tax credit.EVs come with a high price tag. A Tesla Model Y, for instance, has a base price of around $43,990. An all-electric pickup truck, the Ford F-150 Lightning Pro, averages $57,000. Fortunately, the high cost of EVs in 2024 is steeply declining and by 2025 the cars are expected to be far more affordable.Drivers who aim to purchase an EV this year, however, are incentivized by the federal EV tax credit. Using the abovementioned vehicles as examples, the Tesla Model Y has a price tag of $38,130 and the Ford F-150 Lightning Pro costs $49,950 after the EV tax credit.What is the EV tax credit?

The federal EV tax credit is a nonrefundable tax credit available to taxpayers who buy a qualifying EV. The credit is part of the Inflation Reduction Act of 2022 and designed to address climate change, healthcare, and taxes. The legislation modifies how tax credits for EVs are calculated.How much is the EV tax credit?

Buyers may be eligible for up to $7,500 on the purchase of new EVs and up to $4,000 in tax breaks for used vehicles. Vans, SUVs, and pickup trucks should have a MSRP of $80,000 or less to qualify for the incentive. Sedans and passenger cars are capped at $55,000.What is the EV credit based on?

The EV credit depends on where the vehicle is made, the origin of the battery components and minerals, the sticker price of the EV, and the buyer’s income. As of 2024, rules for the incentive are stricter and thereby disqualify some vehicles.The first $3,750 of the tax credit is received when a portion of the battery components are manufactured or assembled in North America. The second half of the tax credit is obtained when the battery’s minerals are processed in the US or in a country that is a free-trade partner.This year, qualifying EVs are based on individual vehicles instead of models. Automakers submit the VINs of eligible vehicles to the IRS and these EVs qualify for the tax credit. Dealerships should inform buyers whether or not a vehicle of interest qualifies for the EV tax incentive.Drivers who wish to claim the EV tax credit must meet income requirements. Their household income must have an adjusted gross income of up to $300,000. The income limit for those filing as head of household is $225,000. Individuals qualify with an income of under $150,000.How do buyers claim the tax credit?

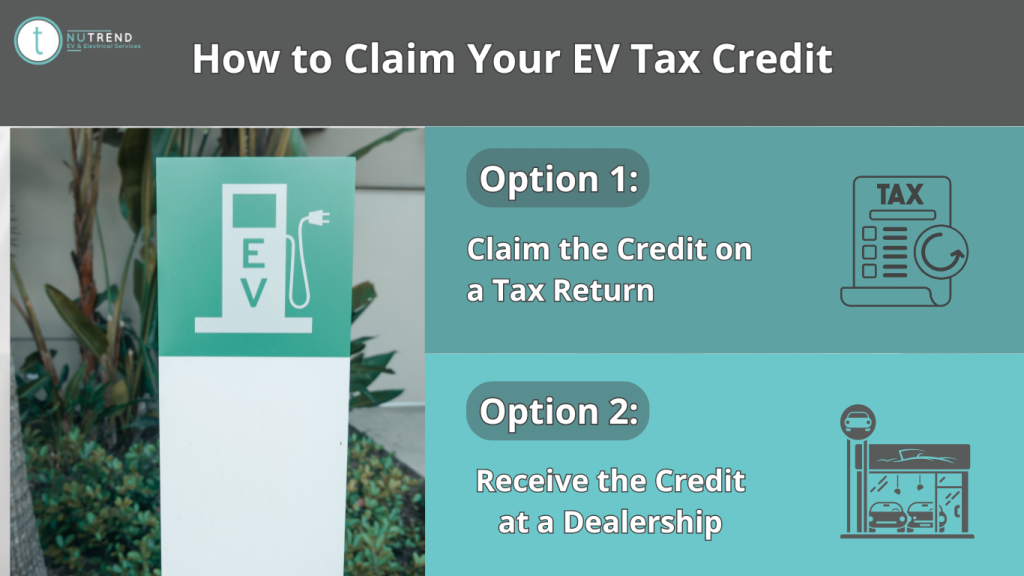

In 2024, buyers have increased flexibility in how they claim the tax credit. Consumers have the choice to either claim a nonrefundable credit on their tax return or claim the credit at the dealership during the point of sale, which lowers the price of the vehicle by the credit amount.

Option 1: Claim the Credit on a Tax Return

Claiming the tax credit requires that taxpayers file IRS Form 8936 when they file their federal income taxes. Being nonrefundable, the tax credit lowers or eliminates tax liability; but once liability hits zero, the taxpayer won’t receive overage of the credit refunded.The EV tax credit is claimed for the tax year the qualifying vehicle is delivered—and not the year in which it is purchased. For example, if the purchase was made in 2023 but not received until 2024, the credit can only be claimed on a 2024 tax return.Option 2: Receive the Credit at the Dealership

As mentioned, buyers have an alternate option to receive the credit at the dealership for a reduction on the price of the EV. While transferring the credit to the dealership offers an immediate discount, buyers must still report the purchase on their federal taxes.When transferring the EV credit to the dealer, consumers must fill out IRS Form 8936 upon filing their tax return to report on their election and provide the agency with the VIN. The buyer must disclose their taxpayer identification number and provide a photo ID at the time of purchase.Buyers should not take a rebate they are ineligible for, otherwise they must pay the IRS back upon filing their taxes. They must also confirm that their modified adjusted gross income falls within the eligibility threshold, the EV is primarily for personal use and the credit is being voluntarily transferred.The rules for the EV tax credit continually evolve with the aim to move EV manufacturing and sourcing away from China and to the US and its free-trade partners. Nevertheless, these rules are complex and make it difficult for buyers to find EVs that qualify for the tax credit. Although the changing rules surrounding the purchase of a EV that qualifies for the tax incentive are confusing, one thing is clear: EV owners benefit from the unparalleled convenience of having an in-home EV charging station installed and maintained by Nu-Trend.We are certified to install Level 2 charging stations in residential homes. Qualified electricians from our company inspect your current electrical system to ensure it can support the necessary voltage. If adjustments are needed, we work with the system to enable the safe installation of a Level 2 charger.Nu-Trend’s Level 2 charging stations are compatible with a wide range of makes and models, including many that qualify for the EV tax credit. We work with Nissan, Ford, BMW, Toyota, and more. Our charging stations are incompatible with Tesla vehicles, however.Our electricians are among the most proficient in the field. We take care of the entire installation process, from obtaining permits to the quality installation and a final inspection. Expect impeccable workmanship and a respect for your space—we also complete the installation quickly and efficiently.Electric vehicle owners in Schaumburg, Illinois, and the surrounding communities, depend on Nu-Trend for the reliable installation of a Level 2 charging station in their residential home. Join our long list of satisfied customers by calling us today for an in-person quote.

Although the changing rules surrounding the purchase of a EV that qualifies for the tax incentive are confusing, one thing is clear: EV owners benefit from the unparalleled convenience of having an in-home EV charging station installed and maintained by Nu-Trend.We are certified to install Level 2 charging stations in residential homes. Qualified electricians from our company inspect your current electrical system to ensure it can support the necessary voltage. If adjustments are needed, we work with the system to enable the safe installation of a Level 2 charger.Nu-Trend’s Level 2 charging stations are compatible with a wide range of makes and models, including many that qualify for the EV tax credit. We work with Nissan, Ford, BMW, Toyota, and more. Our charging stations are incompatible with Tesla vehicles, however.Our electricians are among the most proficient in the field. We take care of the entire installation process, from obtaining permits to the quality installation and a final inspection. Expect impeccable workmanship and a respect for your space—we also complete the installation quickly and efficiently.Electric vehicle owners in Schaumburg, Illinois, and the surrounding communities, depend on Nu-Trend for the reliable installation of a Level 2 charging station in their residential home. Join our long list of satisfied customers by calling us today for an in-person quote.Related Posts:

What Our Cients Say

Vil Varadhan

Nu-Trend did a professional installation job for my EV Charger at home. The technician was thorough and put safety first. Although, it was not cheap – The quality of work gives a peace of mind. They took care of City permit etc.

![]()

Kevin Gallagher

Updated panel from 100 to 200 A and installed EV charger. Team was very professional. Shane was responsive and ushered through the permit. Dave and Jr did a clean install and were respectful in my home. Would consider them for future electrical work.

Martin Gardner

We had Nu-Trend add an EV charging port to our garage which was organized via Qmert, who contracted Nu-Trend to do the installation. I first met Dave, who came out to inspect the job site and put together a quotation; he is an excellent, Knowledgeable, and professional electrician. Shane at Nu-Trend took care of all the paperwork which includes a work permit from the local council and inspection after installation. Dave and a co-worker who was also excellent came to the house and did the installation in about half a day, the quality of the workmanship was impeccable. The work passed Inspection with flying colors.

Electrify Your Journey

Nu-Trend EV offers FREE consultation!

Rewiring Chicago!

Our service doesn’t stop at installing the EV charging station; we also specialize in electrical wiring. If your electrical system needs an upgrade to accommodate the increased power demand of an EV charger, we have the expertise to handle the job efficiently and safely.